NEW: Digital Tax & Accounting*

Bachelor of Arts in Business (BA)

For ambitious high school graduates:

Additional Study & Work-Chance

in top tax consulting and accounting offices

Study Program Digital Tax & Accounting

Bachelor Degree Program Management

Academic training for the profession of tax consultants and accountants

Using digitalization of processes and procedures effectively, thinking analytically and systematically, looking after and advising demanding clients - specialists in tax consulting and accounting offices face a wide variety of professional challenges every day.

Innovative range of courses in cooperation with the "Akademie der Steuerberater & Wirtschaftsprüfer"

The new study branch Digital Tax & Accounting is an innovative study offer for qualification in a core area of the economy, which was developed in cooperation with the "Akademie der Steuerberater & Wirtschaftsprüfer". The program is characterized by the training of qualified employees who take on responsible, job-specific tasks in the economy, especially in tax consulting and auditing firms. It is becoming increasingly important to have solid qualifications in the field of "digitalization". This requirement is justified by the special market requirements and development opportunities that result from digitization in the fields of tax and accounting.

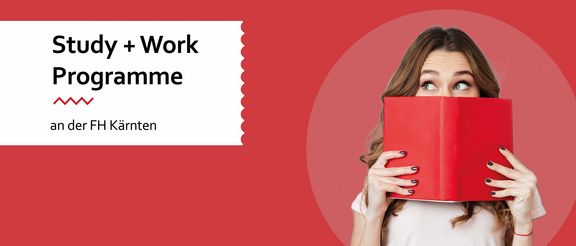

Study & Job

Ambitious high school graduates are offered the opportunity to combine studies with a job. With the study program Digital Tax & Accounting you start an academic education and have the opportunity to work in one of the top tax consulting and accounting offices in Carinthia right from the start. You can find detailed information HERE.

* subject to accreditation by AQ Austria

Online-Infosession buchen

In den Online-Infosessions stellt Ihnen die Programmleitung das Studium detailliert vor. Sie erhalten wertvolle Informationen zu Studieninhalt, Praktika, den Aufnahmevoraussetzungen und den vielfältigen Karrieremöglichkeiten.

Mag.a Dr.in Irina Lindermüller

Program Director Digital Tax & Accounting

+ 43 5 90500 2425

i.lindermueller[at]fh-kaernten[dot]at

Information

Contact

Please contact us if you have any questions about your studies:

Program Director

Bachelor

180.00

€ 363.36 / semester

- Bachelor of Arts in Business

6 semester

€ 25.20 / semester

German

- Villach

General Study Information

Study + Work

With over 100 Study & Work partner companies and organizations, CUAS offers students the opportunity to combine studying and working!

Study & Work for full-time students

- Extent of employment: marginally up to 8h / week possible

- Timetable: Some degree courses are organized so that Monday is a day off.

Study & Work for part-time students

- Scope of employment: part-time up to max. 20h / week possible

- The timetable is organized in a work-friendly way (lectures at the end of the day, weekend, blocked or online).

Profile

Digital Tax & Accounting is a branch of study within the bachelor's program in economics, which combines basic knowledge of business administration with practical know-how. It is positioned at the interface between the areas of Tax & Accounting and Digitalization. The focus is on the following modularly structured subject areas:

- IT & Organization - Data Management

- Digitalization of processes

- IT Law & Security

- Business Information Systems

- Data analytics

- Value Added Tax & Federal Fiscal Code

- Income tax law & cash accounting

- Personnel Accounting

- Corporate law and accounting

- General Management

Close contacts to the business world give students deep insights into professional practice. Compulsory internships take place under the supervision of the lecturers to ensure the best possible success of the students in their working life.

What students should bring to their studies:

- Interest in economic and digital topics.

- The ability to work in teams

- Language and communication skills.

- Responsible behaviour.

- analytical and systemic thinking

- Interest in innovative technologies.

After successful completion of their studies, graduates have the following skills and knowledge:

Graduates in this field of study will deal with tax returns and annual financial statements in addition to payroll and financial accounting. Graduates of the bachelor's program in "Management" with a focus on "Digital Tax & Accounting" are also expected to be able to

- effectively apply the possibilities of digitalizing processes and procedures in accounting,

- develop, implement and use concepts for the use of digital transactions with clients and tax authorities

- to support demanding clients of tax consulting and auditing firms and to prepare complex consultations with regard to content.

Current courses - Management

| Lecture | Type | SPPS | ECTS-Credits | Course number |

|---|---|---|---|---|

| Active Start Group A | ILV | 0,6 | 1,0 | B4.06360.10.020 |

| Active Start Group B | ILV | 0,6 | 1,0 | B4.06360.10.020 |

| Student Orientation Program | ILV | 0,6 | 1,0 | B4.06360.10.020 |

| Business Software Group I | ILV | 2,0 | 3,0 | B4.06360.10.070 |

| Business Software Group I | ILV | 2,0 | 3,0 | B4.06360.10.070 |

| Business Software Group II | ILV | 2,0 | 3,0 | B4.06360.10.070 |

| Business Software Group II | ILV | 2,0 | 3,0 | B4.06360.10.070 |

| Business Software Group III | ILV | 2,0 | 3,0 | B4.06360.10.070 |

| Business Software Group III | ILV | 2,0 | 3,0 | B4.06360.10.070 |

| Collaboration & Cooperation Group A | ILV | 0,9 | 1,5 | B4.06360.10.030 |

| Collaboration & Cooperation Group B | ILV | 0,9 | 1,5 | B4.06360.10.030 |

| English: Persuasive Self-Presentation Group 1 | ILV | 0,8 | 1,0 | B4.06360.10.051 |

| English: Persuasive Self-Presentation Group 2 | ILV | 0,8 | 1,0 | B4.06360.10.051 |

| English: Persuasive Self-Presentation Group 3 | ILV | 0,8 | 1,0 | B4.06360.10.051 |

| English: Persuasive Self-Presentation Group 4 | ILV | 0,8 | 1,0 | B4.06360.10.051 |

| English: Persuasive Self-Presentation Group I | ILV | 0,8 | 1,0 | B4.06360.10.051 |

| English: Persuasive Self-Presentation Group II | ILV | 0,8 | 1,0 | B4.06360.10.051 |

| English: Persuasive Self-Presentation Group III | ILV | 0,8 | 1,0 | B4.06360.10.051 |

| English: Persuasive Self-Presentation Group IV | ILV | 0,8 | 1,0 | B4.06360.10.051 |

| Fundamentals of Accounting Group A | ILV | 3,0 | 5,0 | B4.06360.10.010 |

| Fundamentals of Accounting Group B | ILV | 3,0 | 5,0 | B4.06360.10.010 |

| Fundamentals of Accounting Group A | ILV | 3,0 | 5,0 | B4.06360.10.010 |

| Fundamentals of Accounting Group B | ILV | 3,0 | 5,0 | B4.06360.10.010 |

| HR & Organization Group A | ILV | 3,0 | 5,0 | B4.06360.10.060 |

| HR & Organization Group B | ILV | 3,0 | 5,0 | B4.06360.10.060 |

| Internet & Web Technology Group I | ILV | 1,0 | 2,0 | B4.06360.10.080 |

| Internet & Web Technology Group II | ILV | 1,0 | 2,0 | B4.06360.10.080 |

| Internet & Web Technology Group III | ILV | 1,0 | 2,0 | B4.06360.10.080 |

| Internet & Web Technology Group I | ILV | 1,0 | 2,0 | B4.06360.10.080 |

| Internet & Web Technology Group II | ILV | 1,0 | 2,0 | B4.06360.10.080 |

| Internet & Web Technology Group III | ILV | 1,0 | 2,0 | B4.06360.10.080 |

| Sustainability, Diversity & Business Ethics Group A | ILV | 3,0 | 5,0 | B4.06360.10.090 |

| Sustainability, Diversity & Business Ethics Group B | ILV | 3,0 | 5,0 | B4.06360.10.090 |

| HR & Organization Group A | ILV | 3,0 | 5,0 | B4.06360.10.060 |

| HR & Organization Group B | ILV | 3,0 | 5,0 | B4.06360.10.060 |

| Personal Skills & Development Group A | ILV | 0,9 | 1,5 | B4.06360.10.040 |

| Personal Skills & Development Group B | ILV | 0,9 | 1,5 | B4.06360.10.040 |

| Personal Development Skills Group A | ILV | 0,9 | 1,5 | B4.06360.10.040 |

| Personal Development Skills Group B | ILV | 0,9 | 1,5 | B4.06360.10.040 |

| Sustainability, Diversity & Business Ethics Group A | ILV | 3,0 | 5,0 | B4.06360.10.090 |

| Sustainability, Diversity & Business Ethics Group B | ILV | 3,0 | 5,0 | B4.06360.10.090 |

| Collaboration & Cooperation Group A | ILV | 0,9 | 1,5 | B4.06360.10.030 |

| Collaboration & Cooperation Group B | ILV | 0,9 | 1,5 | B4.06360.10.030 |

| Study program: Business Management | Type | SPPS | ECTS-Credits | Course number |

| Graphic Design | ILV | 3,0 | 5,0 | B4.06360.10.100 |

| Study program: Digital Business Management | Type | SPPS | ECTS-Credits | Course number |

| Media & Internet (video, picture, text) | ILV | 1,0 | 2,0 | B4.06361.10.190 |

| Webcontent Management | ILV | 1,0 | 1,5 | B4.06361.10.210 |

| Webdesign and CMS (Content Management System) | ILV | 1,0 | 1,5 | B4.06361.10.200 |

| Study program: Digital Marketing and Sales | Type | SPPS | ECTS-Credits | Course number |

| Graphic Design Group A | ILV | 3,0 | 5,0 | B4.06360.10.100 |

| Graphic Design Group B | ILV | 3,0 | 5,0 | B4.06360.10.100 |

| Study program: Digital Tax and Accounting | Type | SPPS | ECTS-Credits | Course number |

| Digital interfaces | ILV | 1,2 | 2,0 | B4.06366.10.170 |

| ERP-Customizing | ILV | 0,6 | 1,0 | B4.06366.10.160 |

| Workflow-Management-Systems | ILV | 1,2 | 2,0 | B4.06366.10.180 |

| Study program: Hotel Management | Type | SPPS | ECTS-Credits | Course number |

| Tourism and Destination Management | ILV | 3,0 | 5,0 | B4.06362.10.220 |

| Study program: Intercultural Management | Type | SPPS | ECTS-Credits | Course number |

| Academic English Group A | ILV | 1,1 | 1,5 | B4.06365.10.111 |

| Academic English Group B | ILV | 1,1 | 1,5 | B4.06365.10.111 |

| Deutsch als Fremdsprache 1: Einführung in die Sprache und Kultur Group A | ILV | 2,6 | 3,5 | B4.06365.10.121 |

| Deutsch als Fremdsprache 1: Einführung in die Sprache und Kultur Group B | ILV | 2,6 | 3,5 | B4.06365.10.121 |

| Italiano 1A: Introduzione alla lingua e alla cultura | ILV | 2,6 | 3,5 | B4.06365.10.132 |

| Elective Module for Incomings: Doing Business in Austria | ILV | 3,7 | 6,0 | B4.06365.80.181 |

| Study program: Public Management | Type | SPPS | ECTS-Credits | Course number |

| Fundamentals of politics | ILV | 1,0 | 1,7 | B4.06363.10.240 |

| Fundamentals of public law | ILV | 1,0 | 1,6 | B4.06363.10.230 |

| Fundamentals of public sector | ILV | 1,0 | 1,7 | B4.06363.10.250 |

| Study program: Business Psychology | Type | SPPS | ECTS-Credits | Course number |

| Cognitive and neurobiological foundations of behaviour and experience I | ILV | 3,0 | 5,0 | B4.06367.10.150 |

| Optional subject | Type | SPPS | ECTS-Credits | Course number |

| French I (CEF A1) | ILV | 3,0 | 4,0 | B4.06360.70.320 |

| Spanish I (CEF A1) | ILV | 3,0 | 4,0 | B4.06360.70.290 |

| Spanish I (CEF A1) | ILV | 3,0 | 4,0 | B4.06360.70.290 |

| Lecture | Type | SPPS | ECTS-Credits | Course number |

|---|---|---|---|---|

| English: Current Trend Analysis | ILV | 0,7 | 1,0 | B4.06360.30.041 |

| English: Current Trend Analysis Group I | ILV | 0,7 | 1,0 | B4.06360.30.041 |

| English: Current Trend Analysis Group II | ILV | 0,7 | 1,0 | B4.06360.30.041 |

| English: Current Trend Analysis Group III | ILV | 0,7 | 1,0 | B4.06360.30.041 |

| Fundamentals of Empirical Social Research I | ILV | 0,3 | 0,5 | B4.06360.30.021 |

| Fundamentals of Empirical Social Research I Group A | ILV | 0,3 | 0,5 | B4.06360.30.020 |

| Fundamentals of Empirical Social Research I Group B | ILV | 0,3 | 0,5 | B4.06360.30.020 |

| Research Skills I Group A | ILV | 1,0 | 1,5 | B4.06360.30.010 |

| Research Skills I Group B | ILV | 1,0 | 1,5 | B4.06360.30.010 |

| Methods of Scientific Work I | ILV | 1,0 | 1,5 | B4.06360.30.011 |

| Statistics I | ILV | 2,0 | 3,0 | B4.06360.30.031 |

| Statistics I Group A | ILV | 2,0 | 3,0 | B4.06360.30.030 |

| Statistics I Group B | ILV | 2,0 | 3,0 | B4.06360.30.030 |

| Study program: Business Management | Type | SPPS | ECTS-Credits | Course number |

| Digital Marketing | ILV | 3,5 | 6,0 | B4.06364.30.260 |

| Introduction to Strategic Controlling | ILV | 1,2 | 2,0 | B4.06364.30.300 |

| Employee Lifecycle | ILV | 3,2 | 6,0 | B4.06364.30.250 |

| English for Financing Forms | ILV | 0,7 | 1,0 | B4.06364.30.241 |

| English for General Management | ILV | 0,7 | 1,0 | B4.06364.30.221 |

| Instruments of Strategic Controlling | ILV | 2,3 | 4,0 | B4.06364.30.310 |

| Logistics Management | ILV | 1,2 | 2,0 | B4.06364.30.270 |

| Employee Management | ILV | 1,4 | 2,0 | B4.06364.30.200 |

| New Financing Forms | ILV | 1,7 | 2,5 | B4.06364.30.220 |

| Quality Management | ILV | 1,2 | 2,0 | B4.06364.30.290 |

| Legal Foundations of Financing | ILV | 1,7 | 2,5 | B4.06364.30.230 |

| Supply Chain Management | ILV | 1,2 | 2,0 | B4.06364.30.280 |

| Corporate Management | ILV | 2,0 | 3,0 | B4.06364.30.190 |

| Study program: Digital Business Management | Type | SPPS | ECTS-Credits | Course number |

| Application Development | ILV | 2,0 | 3,5 | B4.06361.30.090 |

| Procurement Management | ILV | 1,5 | 2,0 | B4.06360.70.050 |

| English for Digital Business Management II | ILV | 0,6 | 1,0 | B4.06361.30.081 |

| English: Writing Business Reports Group A | ILV | 0,7 | 1,0 | B4.06360.70.081 |

| English: Writing Business Reports Group B | ILV | 0,7 | 1,0 | B4.06360.70.081 |

| E-Procurement | ILV | 0,9 | 1,5 | B4.06361.30.060 |

| ERP/SAP: Procurement Management Group A | ILV | 0,7 | 1,0 | B4.06360.70.070 |

| ERP/SAP: Procurement Management Group B | ILV | 0,7 | 1,0 | B4.06360.70.070 |

| Fundamentals of economics I: Microeconomics | ILV | 1,9 | 3,5 | B4.06360.70.250 |

| Fundamentals of E-Business and E-Commerce | ILV | 0,9 | 1,5 | B4.06361.30.050 |

| Modelling of business processes | ILV | 1,5 | 2,0 | B4.06360.70.060 |

| Public commercial law Group A | ILV | 1,3 | 2,5 | B4.06360.70.260 |

| Public commercial law Group B | ILV | 1,3 | 2,5 | B4.06360.70.260 |

| Webservices | ILV | 1,4 | 2,5 | B4.06361.30.100 |

| Webshop Systems | ILV | 1,2 | 2,0 | B4.06361.30.070 |

| Study program: Digital Tax and Accounting | Type | SPPS | ECTS-Credits | Course number |

| Federal Tax Code | ILV | 1,3 | 2,0 | B4.06366.30.330 |

| Income and Expenditure Accounting | ILV | 2,0 | 3,0 | B4.06366.30.350 |

| English for General Management | ILV | 0,7 | 1,0 | B4.06364.30.141 |

| Fundamentals of economics I: Microeconomics | ILV | 1,9 | 3,5 | B4.06360.70.250 |

| Fundamentals of Tax Law | ILV | 2,0 | 3,0 | B4.06366.30.340 |

| Employee Management | ILV | 1,4 | 2,0 | B4.06364.30.130 |

| Public commercial law Group A | ILV | 1,3 | 2,5 | B4.06360.70.260 |

| Public commercial law Group B | ILV | 1,3 | 2,5 | B4.06360.70.260 |

| Value Added Tax | ILV | 2,7 | 4,0 | B4.06366.30.320 |

| Corporate Management | ILV | 2,0 | 3,0 | B4.06364.30.120 |

| Study program: Hotel Management | Type | SPPS | ECTS-Credits | Course number |

| Procurement Management | ILV | 1,5 | 2,0 | B4.06360.70.050 |

| English for Hotel Management II | ILV | 0,7 | 1,0 | B4.06362.30.141 |

| English: Writing Business Reports Group A | ILV | 0,7 | 1,0 | B4.06360.70.081 |

| English: Writing Business Reports Group B | ILV | 0,7 | 1,0 | B4.06360.70.081 |

| Experience Staging | ILV | 0,7 | 1,0 | B4.06362.30.130 |

| ERP/SAP: Procurement Management Group A | ILV | 0,7 | 1,0 | B4.06360.70.070 |

| ERP/SAP: Procurement Management Group B | ILV | 0,7 | 1,0 | B4.06360.70.070 |

| Fundamentals of economics I: Microeconomics | ILV | 1,9 | 3,5 | B4.06360.70.250 |

| Hotel Operations II: Food & Beverage und Events | ILV | 3,7 | 6,0 | B4.06362.30.110 |

| Modelling of business processes | ILV | 1,5 | 2,0 | B4.06360.70.060 |

| Public commercial law Group A | ILV | 1,3 | 2,5 | B4.06360.70.260 |

| Public commercial law Group B | ILV | 1,3 | 2,5 | B4.06360.70.260 |

| Service Management and Processes | ILV | 2,7 | 4,0 | B4.06362.30.120 |

| Study program: Intercultural Management | Type | SPPS | ECTS-Credits | Course number |

| Constitution and Administration | ILV | 1,3 | 2,5 | B4.06360.70.101 |

| German 3 Group A | ILV | 4,0 | 6,0 | B4.06365.30.110 |

| German 3 Group B | ILV | 4,0 | 6,0 | B4.06365.30.110 |

| English: Writing Business Reports | ILV | 0,7 | 1,0 | B4.06360.70.081 |

| ERP/SAP: Procurement Management | ILV | 0,7 | 1,0 | B4.06360.70.071 |

| Fundamentals of economics I: Microeconomics | ILV | 1,9 | 3,5 | B4.06360.70.091 |

| Intercultural Teamwork | ILV | 1,8 | 3,0 | B4.06365.30.141 |

| Italian 3A | ILV | 4,0 | 6,0 | B4.06365.30.122 |

| Modelling of business processes | ILV | 1,5 | 2,0 | B4.06360.70.061 |

| Procurement Management | ILV | 1,5 | 2,0 | B4.06360.70.051 |

| Seminar: Intercultural Management | ILV | 1,8 | 3,0 | B4.06365.30.151 |

| Elective Module for Incomings: Doing Business in Austria | ILV | 3,7 | 6,0 | B4.06365.80.181 |

| Study program: Public Management | Type | SPPS | ECTS-Credits | Course number |

| Procurement Management | ILV | 1,5 | 2,0 | B4.06360.70.050 |

| Theories of Democracy & Models of Democracy | ILV | 1,9 | 3,0 | B4.06363.30.180 |

| E-Government | ILV | 1,6 | 3,0 | B4.06363.30.160 |

| English: Writing Business Reports Group A | ILV | 0,7 | 1,0 | B4.06360.70.081 |

| English: Writing Business Reports Group B | ILV | 0,7 | 1,0 | B4.06360.70.081 |

| ERP/SAP: Procurement Management Group A | ILV | 0,7 | 1,0 | B4.06360.70.070 |

| ERP/SAP: Procurement Management Group B | ILV | 0,7 | 1,0 | B4.06360.70.070 |

| Society in Change | ILV | 1,9 | 3,0 | B4.06363.30.190 |

| Fundamentals of economics I: Microeconomics | ILV | 1,9 | 3,5 | B4.06360.70.250 |

| Modelling of business processes | ILV | 1,5 | 2,0 | B4.06360.70.060 |

| Public commercial law Group A | ILV | 1,3 | 2,5 | B4.06360.70.260 |

| Public commercial law Group B | ILV | 1,3 | 2,5 | B4.06360.70.260 |

| Administrative Law | ILV | 1,6 | 3,0 | B4.06363.30.170 |

| Optional subject | Type | SPPS | ECTS-Credits | Course number |

| Pre-Departure Orientation | ILV | 2,0 | 2,0 | B4.06360.70.390 |

| Writing with academic context | ILV | 3,7 | 6,0 | B4.06360.30.400 |

| Lecture | Type | SPPS | ECTS-Credits | Course number |

|---|---|---|---|---|

| Balance Sheet Analysis | ILV | 1,2 | 2,0 | B4.06360.50.011 |

| Investment & Financing II | ILV | 1,2 | 2,0 | B4.06360.50.031 |

| Tax Law | ILV | 1,2 | 2,0 | B4.06360.50.021 |

| Study program: Business Management | Type | SPPS | ECTS-Credits | Course number |

| Balance Sheet Analsyis Group A | ILV | 1,2 | 2,0 | B4.06360.50.010 |

| Balance Sheet Analsyis Group B | ILV | 1,2 | 2,0 | B4.06360.50.010 |

| Business plan preparation | ILV | 2,8 | 6,0 | B4.06364.50.360 |

| Change Management | ILV | 1,2 | 2,0 | B4.06364.50.080 |

| Digital Business Basics | ILV | 1,2 | 2,0 | B4.06364.50.100 |

| Investment & Financing II Group A | ILV | 1,2 | 2,0 | B4.06360.50.030 |

| Investment & Financing II Group B | ILV | 1,2 | 2,0 | B4.06360.50.030 |

| Lean Manufacturing | ILV | 1,8 | 3,0 | B4.06364.50.410 |

| Learning & Development | ILV | 3,2 | 6,0 | B4.06364.50.370 |

| Brand Management | ILV | 3,3 | 6,0 | B4.06364.50.390 |

| Production Management | ILV | 1,2 | 2,0 | B4.06364.50.400 |

| Service Management | ILV | 1,2 | 2,0 | B4.06364.50.090 |

| Smart Factory/Industry 4.0 | ILV | 0,6 | 1,0 | B4.06364.50.420 |

| Tax law Group A | ILV | 1,2 | 2,0 | B4.06360.50.020 |

| Tax law Group B | ILV | 1,2 | 2,0 | B4.06360.50.020 |

| Study program: Digital Business Management | Type | SPPS | ECTS-Credits | Course number |

| Analysis & Optimization | ILV | 0,7 | 1,0 | B4.06361.50.060 |

| Balance Sheet Analsyis Group A | ILV | 1,2 | 2,0 | B4.06360.50.010 |

| Balance Sheet Analsyis Group B | ILV | 1,2 | 2,0 | B4.06360.50.010 |

| Data Protection | ILV | 1,2 | 2,0 | B4.06361.50.100 |

| Digital Processes | ILV | 1,2 | 2,0 | B4.06361.50.120 |

| English for Digital Business Management III | ILV | 0,7 | 1,0 | B4.06361.50.071 |

| Information Economy | ILV | 1,2 | 2,0 | B4.06361.50.130 |

| Internet & Media Law | ILV | 1,2 | 2,0 | B4.06361.50.080 |

| Investment & Financing II Group A | ILV | 1,2 | 2,0 | B4.06360.50.030 |

| Investment & Financing II Group B | ILV | 1,2 | 2,0 | B4.06360.50.030 |

| IT Security | ILV | 1,2 | 2,0 | B4.06361.50.090 |

| Campaign Management / SEO & SEA | ILV | 1,3 | 2,0 | B4.06361.50.050 |

| Project Seminar Group A | ILV | 2,8 | 5,0 | B4.06361.50.140 |

| Project Seminar Group B | ILV | 2,8 | 5,0 | B4.06361.50.140 |

| Digital Business Seminar | ILV | 0,6 | 1,0 | B4.06361.50.150 |

| Smart Factory | ILV | 1,2 | 2,0 | B4.06361.50.110 |

| Tax law Group A | ILV | 1,2 | 2,0 | B4.06360.50.020 |

| Tax law Group B | ILV | 1,2 | 2,0 | B4.06360.50.020 |

| Strategy & Digital Marketing | ILV | 1,3 | 2,0 | B4.06361.50.040 |

| Study program: Digital Tax and Accounting | Type | SPPS | ECTS-Credits | Course number |

| Balance Sheet Analysis | ILV | 1,3 | 2,0 | B4.06366.50.450 |

| Data Protection | ILV | 1,2 | 2,0 | B4.06366.50.530 |

| Digital Interfaces | ILV | 1,3 | 2,0 | B4.06366.50.550 |

| ERP-Customizing | ILV | 1,3 | 2,0 | B4.06366.50.540 |

| Fundamentals of Personnel Accounting | ILV | 2,0 | 3,0 | B4.06366.50.480 |

| Internet & Media Law | ILV | 1,2 | 2,0 | B4.06366.50.510 |

| Investment & Financing II | ILV | 1,3 | 2,0 | B4.06366.50.470 |

| IT Security | ILV | 1,2 | 2,0 | B4.06366.50.520 |

| Consolidated Accounting | ILV | 1,3 | 2,0 | B4.06366.50.460 |

| Simulation: Practical examples of the digitalization of tax consulting processes | ILV | 4,0 | 6,0 | B4.06366.50.500 |

| Social Security Law | ILV | 2,0 | 3,0 | B4.06366.50.490 |

| Workflow-Management-Systems | ILV | 1,3 | 2,0 | B4.06366.50.560 |

| Study program: Hotel Management | Type | SPPS | ECTS-Credits | Course number |

| Balance Sheet Analsyis Group A | ILV | 1,2 | 2,0 | B4.06360.50.010 |

| Balance Sheet Analsyis Group B | ILV | 1,2 | 2,0 | B4.06360.50.010 |

| English for Hotel Management IV | ILV | 0,6 | 1,0 | B4.06362.50.171 |

| Hotel Controlling & Business Simulation | ILV | 3,5 | 6,0 | B4.06362.50.200 |

| Hotel Human Resources Management & Leadership | ILV | 3,2 | 5,0 | B4.06362.50.160 |

| Hotel Real Estate & Financing | ILV | 3,6 | 6,0 | B4.06362.50.180 |

| Investment & Financing II Group A | ILV | 1,2 | 2,0 | B4.06360.50.030 |

| Investment & Financing II Group B | ILV | 1,2 | 2,0 | B4.06360.50.030 |

| Practical project "Hotel development" Analysis, conception, profitability & presentation | ILV | 3,7 | 6,0 | B4.06362.50.190 |

| Tax law Group A | ILV | 1,2 | 2,0 | B4.06360.50.020 |

| Tax law Group B | ILV | 1,2 | 2,0 | B4.06360.50.020 |

| Study program: Intercultural Management | Type | SPPS | ECTS-Credits | Course number |

| Change & Innovation | ILV | 1,2 | 2,0 | B4.06365.50.121 |

| Corporate Sustainability Management | ILV | 1,1 | 2,0 | B4.06365.50.071 |

| Creative Thinking | ILV | 1,2 | 2,0 | B4.06365.50.131 |

| German 5 | ILV | 6,1 | 6,0 | B4.06365.50.040 |

| Entrepreneurship | ILV | 1,2 | 2,0 | B4.06365.50.111 |

| Export & International Business | ILV | 1,2 | 2,0 | B4.06365.50.081 |

| Internal International Consulting | ILV | 1,2 | 2,0 | B4.06365.50.101 |

| Introduction to Values and Ethics | ILV | 2,2 | 4,0 | B4.06365.50.061 |

| Italian 5 | ILV | 6,1 | 6,0 | B4.06365.50.052 |

| Leadership & Diversity | ILV | 1,2 | 2,0 | B4.06365.50.091 |

| Elective Module for Incomings: Doing Business in Austria | ILV | 3,7 | 6,0 | B4.06365.80.181 |

| Study program: Public Management | Type | SPPS | ECTS-Credits | Course number |

| Actors and Instruments of Economic Policy | ILV | 1,2 | 2,0 | B4.06363.50.210 |

| Balance Sheet Analsyis Group A | ILV | 1,2 | 2,0 | B4.06360.50.010 |

| Balance Sheet Analsyis Group B | ILV | 1,2 | 2,0 | B4.06360.50.010 |

| Controlling in the Public Sector | ILV | 1,2 | 2,0 | B4.06363.50.280 |

| Introduction to Political Communication | ILV | 1,2 | 2,0 | B4.06363.50.220 |

| English for Public Management III | ILV | 0,6 | 1,0 | B4.06363.50.241 |

| English for Public Management IV | ILV | 0,7 | 1,0 | B4.06363.50.271 |

| Fundamentals of Intercultural Communication | ILV | 0,6 | 1,0 | B4.06363.50.230 |

| Fundamentals of Public Finance | ILV | 1,8 | 2,5 | B4.06363.50.250 |

| Fundamentals of Public Service Law | ILV | 1,2 | 2,0 | B4.06363.50.300 |

| Investment & Financing II Group A | ILV | 1,2 | 2,0 | B4.06360.50.030 |

| Investment & Financing II Group B | ILV | 1,2 | 2,0 | B4.06360.50.030 |

| Leadership and Personnel in the Public Sector | ILV | 1,2 | 2,0 | B4.06363.50.290 |

| Management of Public Enterprises | ILV | 1,8 | 3,0 | B4.06363.50.320 |

| Non Profit Organizations | ILV | 1,8 | 3,0 | B4.06363.50.310 |

| Public Budgeting | ILV | 1,8 | 2,5 | B4.06363.50.260 |

| Tax law Group A | ILV | 1,2 | 2,0 | B4.06360.50.020 |

| Tax law Group B | ILV | 1,2 | 2,0 | B4.06360.50.020 |

| Lecture | Type | SPPS | ECTS-Credits | Course number |

|---|---|---|---|---|

| Controlling Group A | ILV | 1,0 | 2,0 | B4.06360.20.270 |

| Controlling Group B | ILV | 1,0 | 2,0 | B4.06360.20.270 |

| Controlling Group I | ILV | 1,0 | 2,0 | B4.06360.20.270 |

| Controlling Group II | ILV | 1,0 | 2,0 | B4.06360.20.270 |

| Controlling Group III | ILV | 1,0 | 2,0 | B4.06360.20.270 |

| Cost Accounting Group A | ILV | 2,0 | 3,0 | B4.06360.20.260 |

| Cost Accounting Group B | ILV | 2,0 | 3,0 | B4.06360.20.260 |

| English: Reading in Context Group 1 | ILV | 0,8 | 1,0 | B4.06360.20.301 |

| English: Reading in Context Group 2 | ILV | 0,8 | 1,0 | B4.06360.20.301 |

| English: Reading in Context Group 3 | ILV | 0,8 | 1,0 | B4.06360.20.301 |

| English: Reading in Context Group 4 | ILV | 0,8 | 1,0 | B4.06360.20.301 |

| English: Reading in Context Group I | ILV | 0,8 | 1,0 | B4.06360.20.301 |

| English: Reading in Context Group II | ILV | 0,8 | 1,0 | B4.06360.20.301 |

| English: Reading in Context Group III | ILV | 0,8 | 1,0 | B4.06360.20.301 |

| English: Reading in Context Group IV | ILV | 0,8 | 1,0 | B4.06360.20.301 |

| Fundamentals of Business Law Group A | ILV | 3,0 | 5,0 | B4.06360.20.310 |

| Fundamentals of Business Law Group B | ILV | 3,0 | 5,0 | B4.06360.20.310 |

| Fundamentals of Business Law | ILV | 3,0 | 5,0 | B4.06360.20.310 |

| Collaborative Work Group A | ILV | 3,0 | 5,0 | B4.06364.20.320 |

| Collaborative Work Group B | ILV | 3,0 | 5,0 | B4.06364.20.320 |

| Cost Accounting Group I | ILV | 2,0 | 3,0 | B4.06360.20.260 |

| Cost Accounting Group II | ILV | 2,0 | 3,0 | B4.06360.20.260 |

| Cost Accounting Group III | ILV | 2,0 | 3,0 | B4.06360.20.260 |

| Marketing & Sales Group I | ILV | 3,0 | 5,0 | B4.06360.20.280 |

| Marketing & Sales Group I | ILV | 3,0 | 5,0 | B4.06360.20.280 |

| Marketing & Sales Group II | ILV | 3,0 | 5,0 | B4.06360.20.280 |

| Marketing & Sales Group II | ILV | 3,0 | 5,0 | B4.06360.20.280 |

| Marketing & Sales Group III | ILV | 3,0 | 5,0 | B4.06360.20.280 |

| Marketing & Sales Group III | ILV | 3,0 | 5,0 | B4.06360.20.280 |

| Scientific Work & Writing Group A | ILV | 2,4 | 4,0 | B4.06360.20.290 |

| Scientific Work & Writing Group B | ILV | 2,4 | 4,0 | B4.06360.20.290 |

| Scientific Work & Writing Group I | ILV | 2,4 | 4,0 | B4.06360.20.290 |

| Scientific Work & Writing Group II | ILV | 2,4 | 4,0 | B4.06360.20.290 |

| Scientific Work & Writing Group III | ILV | 2,4 | 4,0 | B4.06360.20.290 |

| Study program: Business Management | Type | SPPS | ECTS-Credits | Course number |

| Enterprise Resource Planning Systems (ERP-Systems) | ILV | 3,0 | 5,0 | B4.06364.20.330 |

| Study program: Digital Business Management | Type | SPPS | ECTS-Credits | Course number |

| Fundamentals of Digital Business Management | ILV | 3,0 | 5,0 | B4.06361.20.380 |

| Study program: Digital Marketing and Sales | Type | SPPS | ECTS-Credits | Course number |

| Collaborative Work | ILV | 3,0 | 5,0 | B4.06364.20.320 |

| Video Editing & Digital Media | ILV | 3,0 | 5,0 | B4.06368.20.351 |

| Study program: Digital Tax and Accounting | Type | SPPS | ECTS-Credits | Course number |

| Group Accounting | ILV | 0,9 | 1,5 | B4.06366.20.370 |

| Austrian Commercial Code (UGB) & Accounting | ILV | 2,1 | 3,5 | B4.06366.20.360 |

| Study program: Hotel Management | Type | SPPS | ECTS-Credits | Course number |

| Einführung in das nachhaltige Hotelmanagement | ILV | 2,4 | 4,0 | B4.06362.20.390 |

| English for Hotel Management | ILV | 0,8 | 1,0 | B4.06362.20.401 |

| Study program: Intercultural Management | Type | SPPS | ECTS-Credits | Course number |

| Deutsch als Fremdsprache 2: Ich und meine Welt Group A | ILV | 2,6 | 3,5 | B4.06365.20.440 |

| Deutsch als Fremdsprache 2: Ich und meine Welt Group B | ILV | 2,6 | 3,5 | B4.06365.20.440 |

| Intercultural Communication | ILV | 1,5 | 2,5 | B4.06365.20.481 |

| Introduction to Values and Ethics | ILV | 1,5 | 2,5 | B4.06365.20.471 |

| Italiano 2A: Io e il mio mondo | ILV | 2,6 | 3,5 | B4.06365.20.452 |

| Professional English Group A | ILV | 1,1 | 1,5 | B4.06365.20.431 |

| Professional English Group B | ILV | 1,1 | 1,5 | B4.06365.20.431 |

| Elective Module for Incomings: Doing Business in Austria | ILV | 3,7 | 6,0 | B4.06365.80.181 |

| Study program: Public Management | Type | SPPS | ECTS-Credits | Course number |

| Grundlagen des öffentlichen Dienstrechts | ILV | 1,0 | 2,0 | B4.06363.20.420 |

| Public Management | ILV | 2,0 | 3,0 | B4.06363.20.410 |

| Study program: Business Psychology | Type | SPPS | ECTS-Credits | Course number |

| Cognitive and neurobiological foundations of behaviour and experience II | ILV | 3,0 | 5,0 | B4.06367.20.340 |

| Optional subject | Type | SPPS | ECTS-Credits | Course number |

| French II (CEF A1) | ILV | 3,0 | 4,0 | B4.06360.80.410 |

| Spanish II (CEF A1) | ILV | 3,0 | 4,0 | B4.06360.80.380 |

| Lecture | Type | SPPS | ECTS-Credits | Course number |

|---|---|---|---|---|

| English: Academic English Group A | ILV | 0,7 | 1,0 | B4.06360.40.091 |

| English: Academic English Group B | ILV | 0,7 | 1,0 | B4.06360.40.091 |

| English: Academic Writing | ILV | 0,7 | 1,0 | B4.06360.40.091 |

| European Law | ILV | 1,8 | 2,5 | B4.06360.40.080 |

| European law | ILV | 1,7 | 2,5 | B4.06360.40.081 |

| Fundamentals of economics II: Macroeconomics | ILV | 1,7 | 2,5 | B4.06360.40.071 |

| Fundamentals of Empirical Social Research II | ILV | 1,5 | 2,5 | B4.06360.40.021 |

| Fundamentals of Empirical Social Research II Group A | ILV | 1,5 | 2,5 | B4.06360.40.020 |

| Fundamentals of Empirical Social Research II Group B | ILV | 1,5 | 2,5 | B4.06360.40.020 |

| Fundamentals of economics II: Macroeconomics Group A | ILV | 1,8 | 2,5 | B4.06360.40.070 |

| Fundamentals of economics II: Macroeconomics Group B | ILV | 1,8 | 2,5 | B4.06360.40.070 |

| Research Skills II Group A | ILV | 0,9 | 1,5 | B4.06360.40.010 |

| Research Skills II Group B | ILV | 0,9 | 1,5 | B4.06360.40.010 |

| Methods of Scientific Work II | ILV | 0,9 | 1,5 | B4.03630.40.011 |

| Project management | ILV | 3,2 | 4,0 | B4.06360.40.041 |

| Project management systems | ILV | 0,8 | 1,0 | B4.06360.40.051 |

| Project Supervision | ILV | 0,8 | 1,0 | B4.06360.40.061 |

| Project Management Group A | ILV | 3,2 | 4,0 | B4.06360.40.040 |

| Project Management Group B | ILV | 3,2 | 4,0 | B4.06360.40.040 |

| Project Management Systems | ILV | 0,8 | 1,0 | B4.06360.40.050 |

| Project subervision Group A | ILV | 0,8 | 1,0 | B4.06360.40.060 |

| Project subervision Group B | ILV | 0,8 | 1,0 | B4.06360.40.060 |

| Statistics II | ILV | 1,2 | 2,0 | B4.06360.40.031 |

| Statistics II Group A | ILV | 1,2 | 2,0 | B4.06360.40.030 |

| Statistics II Group B | ILV | 1,2 | 2,0 | B4.06360.40.030 |

| Study program: Business Management | Type | SPPS | ECTS-Credits | Course number |

| English for Globalization & international Business | ILV | 0,6 | 1,0 | B4.06364.40.221 |

| Export & international economy | ILV | 1,6 | 2,5 | B4.06364.40.200 |

| Fundamentals of international business | ILV | 1,6 | 2,5 | B4.06364.40.210 |

| Living in a changing world | ILV | 3,0 | 6,0 | B4.06364.40.250 |

| Study program: Digital Business Management | Type | SPPS | ECTS-Credits | Course number |

| Introduction Data Engineering | ILV | 1,2 | 2,0 | B4.06361.40.110 |

| Introduction Data Value Chain | ILV | 1,2 | 2,0 | B4.06361.40.100 |

| Introduction BI & Analytics | ILV | 1,2 | 2,0 | B4.06361.40.120 |

| Investment & Financing I | ILV | 1,5 | 3,0 | B4.06360.40.340 |

| Financial Mathematics | ILV | 1,5 | 3,0 | B4.06360.40.350 |

| Study program: Digital Tax and Accounting | Type | SPPS | ECTS-Credits | Course number |

| Introduction Data Engineering | ILV | 1,2 | 2,0 | B4.06366.40.280 |

| Introduction Data Value Chain | ILV | 1,2 | 2,0 | B4.06366.40.270 |

| Introduction BI & Analytics | ILV | 1,2 | 2,0 | B4.06366.40.290 |

| Corporate Code & Accounting | ILV | 4,0 | 6,0 | B4.06366.40.260 |

| Study program: Hotel Management | Type | SPPS | ECTS-Credits | Course number |

| Digital Hotel & Social Media Marketing | ILV | 2,7 | 4,0 | B4.06362.40.130 |

| English for Hotel Management III | ILV | 0,7 | 1,0 | B4.06362.40.161 |

| Hotel Public Relations | ILV | 0,7 | 1,0 | B4.06362.40.150 |

| Investment & Financing I | ILV | 1,5 | 3,0 | B4.06360.40.340 |

| Financial Mathematics | ILV | 1,5 | 3,0 | B4.06360.40.350 |

| Study program: Intercultural Management | Type | SPPS | ECTS-Credits | Course number |

| German 4 Group A | ILV | 4,0 | 6,0 | B4.06365.40.101 |

| German 4 Group B | ILV | 4,0 | 6,0 | B4.06365.40.101 |

| Financial Mathematics | ILV | 1,5 | 3,0 | B4.06360.40.350 |

| Investment & Financing I | ILV | 1,5 | 3,0 | B4.06360.40.340 |

| Italian 4A | ILV | 4,0 | 6,0 | B4.06365.40.112 |

| Elective Module for Incomings: Austrian Language | ILV | 3,7 | 6,0 | B4.06365.80.171 |

| Elective Module for Incomings: Doing Business in Austria | ILV | 3,7 | 6,0 | B4.06365.80.181 |

| Study program: Public Management | Type | SPPS | ECTS-Credits | Course number |

| English for Public Management II | ILV | 0,7 | 1,0 | B4.06363.40.191 |

| Investment & Financing I | ILV | 1,5 | 3,0 | B4.06360.40.340 |

| Comparison of Political Systems | ILV | 1,7 | 2,5 | B4.06363.40.170 |

| Comparison of selected policy fields | ILV | 1,7 | 2,5 | B4.06363.40.180 |

| Financial Mathematics | ILV | 1,5 | 3,0 | B4.06360.40.350 |

| Optional subject | Type | SPPS | ECTS-Credits | Course number |

| Present, Argue, Discuss | ILV | 3,0 | 6,0 | B4.06360.40.370 |

| Present, Argue, Discuss | ILV | 3,0 | 6,0 | B4.06360.40.370 |

| Russian IV | ILV | 3,0 | 4,0 | B4.06360.80.310 |

| Lecture | Type | SPPS | ECTS-Credits | Course number |

|---|---|---|---|---|

| Bachelor Thesis and Bachelor Colloquium | BT | 1,0 | 10,0 | B4.06360.60.011 |

| Bachelor Thesis and Bachelor Colloquium | BT | 1,0 | 10,0 | B4.06360.60.010 |

| Bachelor-Exam | BE | 0,0 | 2,0 | B4.06360.60.021 |

| Bachelor Exam | BE | 0,0 | 2,0 | B4.06360.60.020 |

| Professional Internship | BOPR | 0,0 | 18,0 | B4.06360.00.030 |

| Professional Internship | BOPR | 0,0 | 18,0 | B4.06360.60.030 |

| Lecture | Type | SPPS | ECTS-Credits | Course number |

|---|---|---|---|---|

| Student Orientation Program | ILV | 0,6 | 1,0 | B4.06360.10.020 |

| Business Software | ILV | 2,0 | 3,0 | B4.06360.10.070 |

| English: Persuasive Self-Presentation | ILV | 0,8 | 1,0 | B4.06360.10.051 |

| Fundamentals of Accounting | ILV | 3,0 | 5,0 | B4.06360.10.010 |

| Internet & Web Technology | ILV | 1,0 | 2,0 | B4.06360.10.080 |

| Sustainability, Diversity & Business Ethics | ILV | 3,0 | 5,0 | B4.06360.10.090 |

| HR & Organization | ILV | 3,0 | 5,0 | B4.06360.10.060 |

| Personal Development Skills | ILV | 0,9 | 1,5 | B4.06360.10.040 |

| Collaboration & Cooperation | ILV | 0,9 | 1,5 | B4.06360.10.030 |

| Study program: Business Management | Type | SPPS | ECTS-Credits | Course number |

| Graphic Design | ILV | 3,0 | 5,0 | B4.06360.10.100 |

| Study program: Digital Business Management | Type | SPPS | ECTS-Credits | Course number |

| Media & Internet (video, picture, text) | ILV | 1,0 | 2,0 | B4.06361.10.190 |

| Webcontent Management | ILV | 1,0 | 1,5 | B4.06361.10.210 |

| Webdesign and CMS (Content Management System) | ILV | 1,0 | 1,5 | B4.06361.10.200 |

| Study program: Digital Tax and Accounting | Type | SPPS | ECTS-Credits | Course number |

| Digital interfaces | ILV | 1,2 | 2,0 | B4.06366.10.170 |

| ERP-Customizing | ILV | 0,6 | 1,0 | B4.06366.10.160 |

| Workflow-Management-Systems | ILV | 1,2 | 2,0 | B4.06366.10.180 |

| Study program: Hotel Management | Type | SPPS | ECTS-Credits | Course number |

| Tourism and Destination Management | ILV | 3,0 | 5,0 | B4.06362.10.220 |

| Study program: Public Management | Type | SPPS | ECTS-Credits | Course number |

| Fundamentals of politics | ILV | 1,0 | 1,7 | B4.06363.10.240 |

| Fundamentals of public law | ILV | 1,0 | 1,6 | B4.06363.10.230 |

| Fundamentals of public sector | ILV | 1,0 | 1,7 | B4.06363.10.250 |

| Study program: Business Psychology | Type | SPPS | ECTS-Credits | Course number |

| Cognitive and neurobiological foundations of behaviour and experience I | ILV | 3,0 | 5,0 | B4.06367.10.150 |

| Optional subject | Type | SPPS | ECTS-Credits | Course number |

| French I (CEF A1) | ILV | 3,0 | 4,0 | B4.06360.70.320 |

| Italian I (CEF A1) | ILV | 3,0 | 4,0 | B4.06360.70.272 |

| Croatian I | ILV | 3,0 | 4,0 | B4.06360.70.310 |

| Russian I (CEF A1) | ILV | 3,0 | 4,0 | B4.06360.70.280 |

| Slovene I (CEF A1) | ILV | 3,0 | 4,0 | B4.06360.70.300 |

| Spanish I (CEF A1) | ILV | 3,0 | 4,0 | B4.06360.70.290 |

| Lecture | Type | SPPS | ECTS-Credits | Course number |

|---|---|---|---|---|

| Digital Marketing | ILV | 3,0 | 5,0 | B4.06360.30.530 |

| English: Current Trend Analysis | ILV | 0,8 | 1,0 | B4.06360.30.521 |

| English: Writing Reports | ILV | 0,8 | 1,0 | B4.06360.30.501 |

| Research Methods | ILV | 2,4 | 4,0 | B4.06360.30.490 |

| Quantitative Data Analysis | ILV | 2,4 | 4,0 | B4.06360.30.510 |

| Study program: Business Management | Type | SPPS | ECTS-Credits | Course number |

| Bilanzanalyse | ILV | 1,5 | 2,5 | B4.06360.30.540 |

| Operatives Controlling I | ILV | 1,5 | 2,5 | B4.06364.30.590 |

| Operatives Controlling II | ILV | 1,5 | 2,5 | B4.06364.30.600 |

| Self & Employee Management | ILV | 3,0 | 5,0 | B4.06360.30.560 |

| Steuerrecht | ILV | 1,5 | 2,5 | B4.06360.30.550 |

| Study program: Digital Business Management | Type | SPPS | ECTS-Credits | Course number |

| English for B2B Relationship Management | ILV | 0,7 | 1,0 | B4.06361.30.701 |

| English for Software Development & Coding | ILV | 0,8 | 1,0 | B4.06361.30.721 |

| Grundlagen E-Business/E-Commerce/E-Procurement | ILV | 1,5 | 2,5 | B4.06361.30.680 |

| Software Development & Coding | ILV | 5,4 | 9,0 | B4.06361.30.710 |

| Webshopsysteme | ILV | 1,0 | 1,5 | B4.06361.30.690 |

| Study program: Digital Tax and Accounting | Type | SPPS | ECTS-Credits | Course number |

| Bilanzanalyse | ILV | 1,5 | 2,5 | B4.06360.30.540 |

| Einnahmen-Ausgaben-Rechnung | ILV | 1,5 | 2,5 | B4.06366.30.670 |

| Ertragsteuerrecht | ILV | 1,5 | 2,5 | B4.06366.30.660 |

| Fundamentals of European Law | ILV | 1,5 | 2,5 | B4.06360.30.580 |

| Austrian and International Company Law | ILV | 1,5 | 2,5 | B4.06360.30.570 |

| Steuerrecht | ILV | 1,5 | 2,5 | B4.06360.30.550 |

| Study program: Hotel Management | Type | SPPS | ECTS-Credits | Course number |

| English for the Front Desk | ILV | 0,8 | 1,0 | B4.06362.30.741 |

| Hotel Operations I: Rooms Division & Spa Management | ILV | 2,4 | 4,0 | B4.06362.30.730 |

| Hotel Operations II: Food & Beverage und Bankett Management | ILV | 3,0 | 5,0 | B4.06362.30.750 |

| Self & Employee Management | ILV | 3,0 | 5,0 | B4.06360.30.560 |

| Study program: Public Management | Type | SPPS | ECTS-Credits | Course number |

| Fundamentals of European Law | ILV | 1,5 | 2,5 | B4.06360.30.580 |

| Austrian and International Company Law | ILV | 1,5 | 2,5 | B4.06360.30.570 |

| Politisches System Österreich und EU | ILV | 2,0 | 3,0 | B4.06363.30.760 |

| Verfassungs- und Verwaltungsrecht | ILV | 3,0 | 5,0 | B4.06363.30.780 |

| Wirtschaftspolitik | ILV | 1,0 | 2,0 | B4.06363.30.770 |

| Study program: Business Psychology | Type | SPPS | ECTS-Credits | Course number |

| Persönlichkeits- und differentielle Psychologie | ILV | 1,5 | 2,5 | B4.06367.30.620 |

| Self & Employee Management | ILV | 3,0 | 5,0 | B4.06360.30.560 |

| Soziale Grundlagen des Verhaltens und Erlebens: Sozialpsychologie | ILV | 3,0 | 5,0 | B4.06367.30.610 |

| Testtheorie & psychologische Diagnostik | ILV | 1,5 | 2,5 | B4.06367.30.630 |

| Optional subject | Type | SPPS | ECTS-Credits | Course number |

| French III | ILV | 2,0 | 2,0 | B4.06360.70.380 |

| Italian III | ILV | 3,0 | 4,0 | B4.06360.70.332 |

| Croatian III | ILV | 2,0 | 2,0 | B4.06360.70.360 |

| Pre-Departure Orientation | ILV | 2,0 | 2,0 | B4.06360.70.390 |

| Russian III | ILV | 3,0 | 4,0 | B4.06360.70.340 |

| Writing with academic context | ILV | 3,0 | 5,0 | B4.06360.30.400 |

| Slovene III | ILV | 3,0 | 4,0 | B4.06360.70.370 |

| Spanish III | ILV | 2,0 | 2,0 | B4.06360.70.350 |

| Study program: Business Management | Type | SPPS | ECTS-Credits | Course number |

|---|---|---|---|---|

| Balance Sheet Analsyis | ILV | 1,2 | 2,0 | B4.06360.50.010 |

| Business plan preparation | ILV | 2,8 | 6,0 | B4.06364.50.360 |

| Change Management | ILV | 1,2 | 2,0 | B4.06364.50.080 |

| Digital Business Basics | ILV | 1,2 | 2,0 | B4.06364.50.100 |

| Investment & Financing II | ILV | 1,2 | 2,0 | B4.06360.50.030 |

| Lean Manufacturing | ILV | 1,8 | 3,0 | B4.06364.50.410 |

| Learning & Development | ILV | 3,2 | 6,0 | B4.06364.50.370 |

| Brand Management | ILV | 3,3 | 6,0 | B4.06364.50.390 |

| Operational Controlling I: Operational Planning, Budgeting & Liquidity | ILV | 1,7 | 3,0 | B4.06364.50.430 |

| Operational Controlling II: Cost management techniques | ILV | 1,7 | 3,0 | B4.06364.50.440 |

| Production Management | ILV | 1,2 | 2,0 | B4.06364.50.400 |

| Service Management | ILV | 1,2 | 2,0 | B4.06364.50.090 |

| Smart Factory/Industry 4.0 | ILV | 0,6 | 1,0 | B4.06364.50.420 |

| Tax law | ILV | 1,2 | 2,0 | B4.06360.50.020 |

| Study program: Digital Business Management | Type | SPPS | ECTS-Credits | Course number |

| Analysis & Optimization | ILV | 0,7 | 1,0 | B4.06361.50.060 |

| Balance Sheet Analsyis | ILV | 1,2 | 2,0 | B4.06360.50.010 |

| Data Protection | ILV | 1,2 | 2,0 | B4.06361.50.100 |

| Digital Processes | ILV | 1,2 | 2,0 | B4.06361.50.120 |

| English for Digital Business Management III | ILV | 0,7 | 1,0 | B4.06361.50.071 |

| Information Economy | ILV | 1,2 | 2,0 | B4.06361.50.130 |

| Internet & Media Law | ILV | 1,2 | 2,0 | B4.06361.50.080 |

| Investment & Financing II | ILV | 1,2 | 2,0 | B4.06360.50.030 |

| IT Security | ILV | 1,2 | 2,0 | B4.06361.50.090 |

| Campaign Management / SEO & SEA | ILV | 1,3 | 2,0 | B4.06361.50.050 |

| Project Seminar | ILV | 2,8 | 5,0 | B4.06361.50.140 |

| Digital Business Seminar | ILV | 0,6 | 1,0 | B4.06361.50.150 |

| Smart Factory | ILV | 1,2 | 2,0 | B4.06361.50.110 |

| Tax law | ILV | 1,2 | 2,0 | B4.06360.50.020 |

| Strategy & Digital Marketing | ILV | 1,3 | 2,0 | B4.06361.50.040 |

| Study program: Digital Tax and Accounting | Type | SPPS | ECTS-Credits | Course number |

| Balance Sheet Analysis | ILV | 1,3 | 2,0 | B4.06366.50.450 |

| Data Protection | ILV | 1,2 | 2,0 | B4.06366.50.530 |

| Digital Interfaces | ILV | 1,3 | 2,0 | B4.06366.50.550 |

| ERP-Customizing | ILV | 1,3 | 2,0 | B4.06366.50.540 |

| Fundamentals of Personnel Accounting | ILV | 2,0 | 3,0 | B4.06366.50.480 |

| Internet & Media Law | ILV | 1,2 | 2,0 | B4.06366.50.510 |

| Investment & Financing II | ILV | 1,3 | 2,0 | B4.06366.50.470 |

| IT Security | ILV | 1,2 | 2,0 | B4.06366.50.520 |

| Consolidated Accounting | ILV | 1,3 | 2,0 | B4.06366.50.460 |

| Simulation: Practical examples of the digitalization of tax consulting processes | ILV | 4,0 | 6,0 | B4.06366.50.500 |

| Social Security Law | ILV | 2,0 | 3,0 | B4.06366.50.490 |

| Workflow-Management-Systems | ILV | 1,3 | 2,0 | B4.06366.50.560 |

| Study program: Hotel Management | Type | SPPS | ECTS-Credits | Course number |

| Balance Sheet Analsyis | ILV | 1,2 | 2,0 | B4.06360.50.010 |

| English for Hotel Management IV | ILV | 0,6 | 1,0 | B4.06362.50.171 |

| Hotel Controlling & Business Simulation | ILV | 3,5 | 6,0 | B4.06362.50.200 |

| Hotel Human Resources Management & Leadership | ILV | 3,2 | 5,0 | B4.06362.50.160 |

| Hotel Real Estate & Financing | ILV | 3,6 | 6,0 | B4.06362.50.180 |

| Investment & Financing II | ILV | 1,2 | 2,0 | B4.06360.50.030 |

| Practical project "Hotel development" Analysis, conception, profitability & presentation | ILV | 3,7 | 6,0 | B4.06362.50.190 |

| Tax law | ILV | 1,2 | 2,0 | B4.06360.50.020 |

| Study program: Public Management | Type | SPPS | ECTS-Credits | Course number |

| Actors and Instruments of Economic Policy | ILV | 1,2 | 2,0 | B4.06363.50.210 |

| Balance Sheet Analsyis | ILV | 1,2 | 2,0 | B4.06360.50.010 |

| Controlling in the Public Sector | ILV | 1,2 | 2,0 | B4.06363.50.280 |

| Introduction to Political Communication | ILV | 1,2 | 2,0 | B4.06363.50.220 |

| English for Public Management III | ILV | 0,6 | 1,0 | B4.06363.50.241 |

| English for Public Management IV | ILV | 0,7 | 1,0 | B4.06363.50.271 |

| Fundamentals of Intercultural Communication | ILV | 0,6 | 1,0 | B4.06363.50.230 |

| Fundamentals of Public Finance | ILV | 1,8 | 2,5 | B4.06363.50.250 |

| Fundamentals of Public Service Law | ILV | 1,2 | 2,0 | B4.06363.50.300 |

| Investment & Financing II | ILV | 1,2 | 2,0 | B4.06360.50.030 |

| Leadership and Personnel in the Public Sector | ILV | 1,2 | 2,0 | B4.06363.50.290 |

| Management of Public Enterprises | ILV | 1,8 | 3,0 | B4.06363.50.320 |

| Non Profit Organizations | ILV | 1,8 | 3,0 | B4.06363.50.310 |

| Public Budgeting | ILV | 1,8 | 2,5 | B4.06363.50.260 |

| Tax law | ILV | 1,2 | 2,0 | B4.06360.50.020 |

| Optional subject | Type | SPPS | ECTS-Credits | Course number |

| French V | ILV | 2,0 | 2,0 | B4.06360.70.660 |

| Italian V | ILV | 2,0 | 2,0 | B4.06360.70.612 |

| Croatian V | ILV | 2,0 | 2,0 | B4.06360.70.640 |

| Russian V | ILV | 2,0 | 2,0 | B4.06360.70.620 |

| Slovene V | ILV | 2,0 | 2,0 | B4.06360.70.650 |

| Spanish V | ILV | 2,0 | 2,0 | B4.06360.70.630 |

| Lecture | Type | SPPS | ECTS-Credits | Course number |

|---|---|---|---|---|

| Controlling | ILV | 1,0 | 2,0 | B4.06360.20.270 |

| English: Reading in Context | ILV | 0,8 | 1,0 | B4.06360.20.301 |

| Fundamentals of Business Law | ILV | 3,0 | 5,0 | B4.06360.20.310 |

| Collaborative Work | ILV | 3,0 | 5,0 | B4.06364.20.320 |

| Cost Accounting | ILV | 2,0 | 3,0 | B4.06360.20.260 |

| Marketing & Sales | ILV | 3,0 | 5,0 | B4.06360.20.280 |

| Scientific Work & Writing | ILV | 2,4 | 4,0 | B4.06360.20.290 |

| Study program: Business Management | Type | SPPS | ECTS-Credits | Course number |

| Enterprise Resource Planning Systems (ERP-Systems) | ILV | 3,0 | 5,0 | B4.06364.20.330 |

| Study program: Digital Business Management | Type | SPPS | ECTS-Credits | Course number |

| Fundamentals of Digital Business Management | ILV | 3,0 | 5,0 | B4.06361.20.380 |

| Study program: Digital Tax and Accounting | Type | SPPS | ECTS-Credits | Course number |

| Group Accounting | ILV | 0,9 | 1,5 | B4.06366.20.370 |

| Austrian Commercial Code (UGB) & Accounting | ILV | 2,1 | 3,5 | B4.06366.20.360 |

| Study program: Hotel Management | Type | SPPS | ECTS-Credits | Course number |

| Einführung in das nachhaltige Hotelmanagement | ILV | 2,4 | 4,0 | B4.06362.20.390 |

| English for Hotel Management | ILV | 0,8 | 1,0 | B4.06362.20.401 |

| Study program: Public Management | Type | SPPS | ECTS-Credits | Course number |

| Grundlagen des öffentlichen Dienstrechts | ILV | 1,0 | 2,0 | B4.06363.20.420 |

| Public Management | ILV | 2,0 | 3,0 | B4.06363.20.410 |

| Study program: Business Psychology | Type | SPPS | ECTS-Credits | Course number |

| Cognitive and neurobiological foundations of behaviour and experience II | ILV | 3,0 | 5,0 | B4.06367.20.340 |

| Optional subject | Type | SPPS | ECTS-Credits | Course number |

| French II (CEF A1) | ILV | 3,0 | 4,0 | B4.06360.80.410 |

| Italian II (CEF A1) | ILV | 3,0 | 4,0 | B4.06360.80.362 |

| Croatian II | ILV | 3,0 | 2,0 | B4.06360.80.390 |

| Russian II (CEF A1) | ILV | 3,0 | 4,0 | B4.06360.80.370 |

| Slovene II (CEF A1) | ILV | 3,0 | 4,0 | B4.06360.80.400 |

| Spanish II (CEF A1) | ILV | 3,0 | 4,0 | B4.06360.80.380 |

| Lecture | Type | SPPS | ECTS-Credits | Course number |

|---|---|---|---|---|

| Business Intelligence & Analytics | ILV | 3,0 | 5,0 | B4.06360.40.840 |

| Change Management & Conflict Management | ILV | 2,4 | 4,0 | B4.06360.40.850 |

| English: Communication with Impact | ILV | 0,8 | 1,0 | B4.06360.40.861 |

| Project Management | ILV | 3,0 | 5,0 | B4.06360.40.880 |

| Economics | ILV | 3,0 | 5,0 | B4.06360.40.870 |

| Study program: Business Management | Type | SPPS | ECTS-Credits | Course number |

| Geschäftsprozessmanagement | ILV | 1,0 | 2,0 | B4.06360.40.900 |

| Operational People Management | ILV | 3,0 | 5,0 | B4.06360.40.890 |

| Value Stream Management | ILV | 2,0 | 3,0 | B4.06360.40.910 |

| Study program: Digital Business Management | Type | SPPS | ECTS-Credits | Course number |

| Geschäftsprozessmanagement | ILV | 1,0 | 2,0 | B4.06360.40.900 |

| Robotic Process Automation & Künstliche Intelligenz (KI) | ILV | 3,0 | 5,0 | B4.06361.40.1010 |

| Value Stream Management | ILV | 2,0 | 3,0 | B4.06360.40.910 |

| Study program: Digital Tax and Accounting | Type | SPPS | ECTS-Credits | Course number |

| Abschlussprüfung nach nationalen und internationalen Standards | ILV | 3,0 | 5,0 | B4.06366.40.1000 |

| English for Tax Consultants | ILV | 0,8 | 1,0 | B4.06366.40.991 |

| Internationale Steuerlehre | ILV | 0,6 | 1,0 | B4.06366.40.980 |

| Körperschaftsteuer | ILV | 1,8 | 3,0 | B4.06366.40.970 |

| Study program: Hotel Management | Type | SPPS | ECTS-Credits | Course number |

| English for Service Recovery | ILV | 0,8 | 1,0 | B4.06362.40.1041 |

| Hotel Service Experience & Qualitätsmanagement | ILV | 2,4 | 4,0 | B4.06362.40.1030 |

| Hotelvertrieb, Revenue Management & Business Events | ILV | 3,0 | 5,0 | B4.06362.40.1020 |

| Study program: Public Management | Type | SPPS | ECTS-Credits | Course number |

| Demokratiemodelle und Demokratietheorie | ILV | 1,5 | 2,5 | B4.06363.40.1050 |

| Gesellschaftlicher Wandel | ILV | 1,5 | 2,5 | B4.06363.40.1060 |

| Global Relationships | ILV | 1,5 | 2,5 | B4.06360.40.930 |

| Political Systems in Comparison | ILV | 1,5 | 2,5 | B4.06360.40.920 |

| Study program: Business Psychology | Type | SPPS | ECTS-Credits | Course number |

| Arbeitspsychologie, Arbeit und Gesundheit & Digitalität | ILV | 3,0 | 5,0 | B4.06367.40.940 |

| Operational People Management | ILV | 3,0 | 5,0 | B4.06360.40.890 |

| Optional subject | Type | SPPS | ECTS-Credits | Course number |

| French IV | ILV | 2,0 | 2,0 | B4.06360.80.350 |

| Italian IV | ILV | 3,0 | 4,0 | B4.06360.80.302 |

| Croatian IV | ILV | 2,0 | 2,0 | B4.06360.80.330 |

| Present, Argue, Discuss | ILV | 3,0 | 5,0 | B4.06360.40.370 |

| Re-Entry Orientation | ILV | 2,0 | 2,0 | B4.06360.80.360 |

| Russian IV | ILV | 3,0 | 4,0 | B4.06360.80.310 |

| Slovene IV | ILV | 3,0 | 4,0 | B4.06360.80.340 |

| Spanish IV | ILV | 2,0 | 2,0 | B4.06360.80.320 |

| Lecture | Type | SPPS | ECTS-Credits | Course number |

|---|---|---|---|---|

| Bachelor Thesis and Bachelor Colloquium | BT | 1,0 | 10,0 | B4.06360.60.010 |

| Bachelor Exam | BE | 0,0 | 2,0 | B4.06360.60.020 |

| Professional Internship | BOPR | 0,0 | 18,0 | B4.06360.00.030 |

| Optional subject | Type | SPPS | ECTS-Credits | Course number |

| French VI | ILV | 2,0 | 2,0 | B4.06360.80.110 |

| Voluntary extended internship | ILV | 0,0 | 0,0 | B4.06360.80.050 |

| Italian VI | ILV | 2,0 | 2,0 | B4.06360.80.062 |

| Croatian VI | ILV | 2,0 | 2,0 | B4.06360.80.090 |

| Russian VI | ILV | 2,0 | 2,0 | B4.06360.80.070 |

| Slovene VI | ILV | 2,0 | 2,0 | B4.06360.80.100 |

| Spanish VI | ILV | 2,0 | 2,0 | B4.06360.80.080 |

Job & Career

Due to the interdisciplinary education in the bachelor's degree program in economics, graduates* in the individual branches of study are offered very good career opportunities in the respective industries. In addition to their professional know-how, graduates have extensive key qualifications and skills. In particular, knowledge in the following areas comes into play:

- IT & Organization - Data Management

- Digitalization of processes

- IT Law & Security

- Business Information Systems

- Data analytics

- Value Added Tax & Federal Fiscal Code

- Income tax law & cash accounting

- Personnel Accounting

- Corporate law and accounting

- General Management

In order to prepare students for their entry into professional life, the work placement is a particularly important part of the curriculum. Practical units enable the direct implementation and deepening of already acquired knowledge in practice, so that the knowledge can be further developed "on the job". In addition, important initial contacts are made with potential employers. It is not unusual for a concrete job offer to result from the internship.

The successful completion of the bachelor's degree entitles the student to a master's degree in Business & Management at a university of applied sciences or university.

Statements

Practice-oriented business education & profile-building specializations

SPECIFIC KEY AND FUTURE SKILLS

The Bachelor study program in Management offers a compact, practice-oriented basic education in economics. In addition, there is a strong focus on teaching key and future skills tailored to the respective branches of study (6 German-language and 2 English-language) from the first semester onwards. This profile-building specialization accounts for more than half of the total course content. Current topics such as sustainability, digitality, internationality and diversity are an integral part of many modules.

PRACTICAL RELEVANCE

The high practical relevance of the study program is ensured by close cooperation with regional, national and international companies as well as the use of experienced lecturers from industry, business and institutions, who bring current topics and new developments from professional practice into the study program or can also be experienced in excursions. The students' transfer skills are strengthened by working on specific and current practical tasks.

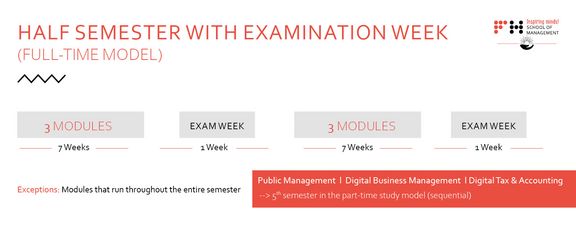

Degree program management full-time: modern study time model

Faculty and Staff - Digital Tax & Accounting

FH-Prof. Mag. Dr.

Thomas Fenzl

FH-Prof.in Mag.a

Hermine Bauer

Mag.

Michaela Rosenwirth

MMag.a

Julia Ebenberger-Fidebauer

Evelyn Eigner

Romana Pechac

Rita Maria Elsa Marak, BA MA

Mag.a

Margit Schager

MMag.a

Jirina Egarter, MSc

Mag.

Georg Jeschke

Mag.a (FH) Dr.

Marika Gruber

Janet Brown, MA MA

FH-Prof. Mag. Dr. rer. soc. oec.

Stefan Dreisiebner

FH-Prof.in Mag.a Dr.in

Ursula Liebhart

FH-Prof.in Dr.in

Eithne Knappitsch

Mag.

Wolfgang Leitner

FH-Prof. MMag. Dr.

Florian Oppitz

FH-Prof. Dr.

Anna Hauser-Oppelmayer, Bakk. MSc

FH-Prof.in Mag. (FH) Dr.in

Birgit Aigner-Walder

Dipl.-Ing.

Martin Stromberger

FH-Prof. Dipl.BW FH

Stefan Nungesser

FH-Prof. Mag. Dr.

Dietmar Sternad, BSc MBA

FH-Prof.in MMag.a Dr.in

Kathrin Stainer-Hämmerle

Mag.a

Andrea Gaggl

Dr. rer. soc. oec.

Cornelia Mayr, BA

FH-Prof.in MMag.a Dr.in

Vera Seyer

Verena Fink, B.A. MA

Jessica Pöcher, B.A.

DI

Wolfgang Almer

Hon.-Prof. (FH) Mag.

Günter Bauer

Pierre Bechler, BSc MA

Mag.

Thomas Bodner

Mag.a Dr.

Barbara Covarrubias Venegas

Mag.

Verena Cozelenka

Mag.a Dr.in

Daniela Ebner

Caro Frank

MMag.a

Sabine Friesser

Mag.a

Marlies Gatterbauer

Dr.

Bernhard Glawitsch

Christina Graf, BA

Mag.

Christof Gruber-Harrich

Mag.a

Ute Hammerschall

Dr.

Gerald Hobisch

MMag. Dr.

Meinrad Höfferer

Mag.

Christian Inzko

Dr. iur. Dr.

Ulrich Kraßnig, LL.M.

MMag.a

Eva Maria Köffler-Malliga

Mag.

Hannes Mahl

Dr.

Stefan Mitterdorfer

Mag.

Richard Petz, BSc

MMag.

Florian Pibal, Bakk.

Peter Plaikner

Mag. Dr.

Manfred Prisching

DI

Reiner Rabensteiner

Barbara Rauscher, MA

Mag.a phil.

Katharina Rodgers

DI

Wolfgang Schurian, BA

Dr.in

Barbara Stampf

Mag.a

Eva Maria Stefaner, BA

Hon.-Prof.in (FH) MMag.a Dr.in

Gabriele Stoiser

Mag.

Bernhard Venhauer

Steuerberaterin Mag.

Eva Maria Winkler

Kathrin Wutej, BSc MSc

Dr.

Anna Zinenko

Campus & Arrival

Villach

The Villach region combines tradition, cosmopolitanism and quality of life with the advantages of an innovative business location. Villach, a small town with about 60,000 inhabitants, is an international high-tech location with groundbreaking cooperation between science and industry and is also increasingly developing into a start-up town.

Situated directly at the intersection of three cultures, Villach, situated on the Drava river, is an important traffic junction in the Alps-Adriatic region. This special geographical location and the beautiful landscape around Villach and in the federal state of Carinthia have made the region a popular holiday destination for generations, further beyond the borders. The drinking water quality of the lakes and the particularly clean air make Villach and its surroundings an environmental paradise.

In addition to its geographical advantages, Austria also leads the world in terms of its social and health care system and is considered a particularly safe, prosperous and liveable country.

Despite the above-average prosperity and the comprehensive state social benefits, Villach compares favourably with many international destinations. The "small town bonus" comes into its own here and makes everyday life affordable.

Explore Campus Villach on a 360° Tour.

Make a virtual walk through the Science & Energy Labs – T10.

Motorway exit Wernberg, then on the B 83 approx. 2 km in the direction of Villach, after the Villach town sign the B83 passes under the A2 motorway, and then immediately right the first exit in the direction of MAGDALENEN SEE. Following the signs for Magdalenen See, the road leads through a small wooded area, always follow the road, after an S-curve past Magdalenen See (left) always straight ahead, cross the southern railway line and go uphill directly into the centre of St. Magdalene. Turn right at the top of the hill, down the road, the grounds of the technology park are already visible to the south, the chimney of the combined heat and power plant, and directly in the sharp right-hand bend turn left onto the grounds of the technology park.

Motorway exit Villach/Ossiacher See, then approx. 2 km in the direction of Villach, on the right is Gasthof Seehof, on the left is Lake Vassach, continue on the B33 left in the direction of east, Wernberg, Klagenfurt, always follow the B33, after approx. 4 km turn right in the direction of Magdalenen See. The road leads through a small forest, always follow the road, after an S-curve past Lake Magdalenen (left) always straight ahead, cross the southern railway line and go uphill directly into the centre of St.Magdalen. Turn right at the top of the hill, down the road, the grounds of the technology park are already visible to the south, the chimney of the combined heat and power plant, and directly in the sharp right-hand bend turn left onto the grounds of the technology park.

The bus company Dr. Richard runs from Villach city to the FH in about every 15 minutes. The timetables are coordinated with the timetables of the ÖBB.

Contact

Europastraße 4

9524 Villach, Austria

+43 5 90500 7700

villach[at]fh-kaernten[dot]at

Explore Campus Villach on a 360° Tour.